Куда пропало колчаковское золото? Историкам и кладоискателям так и не удалось найти ответ на

Характеристика жука скарабея, внешнее описание, особенности. Образ жизни, питание, размножение, польза для окружающей среды,

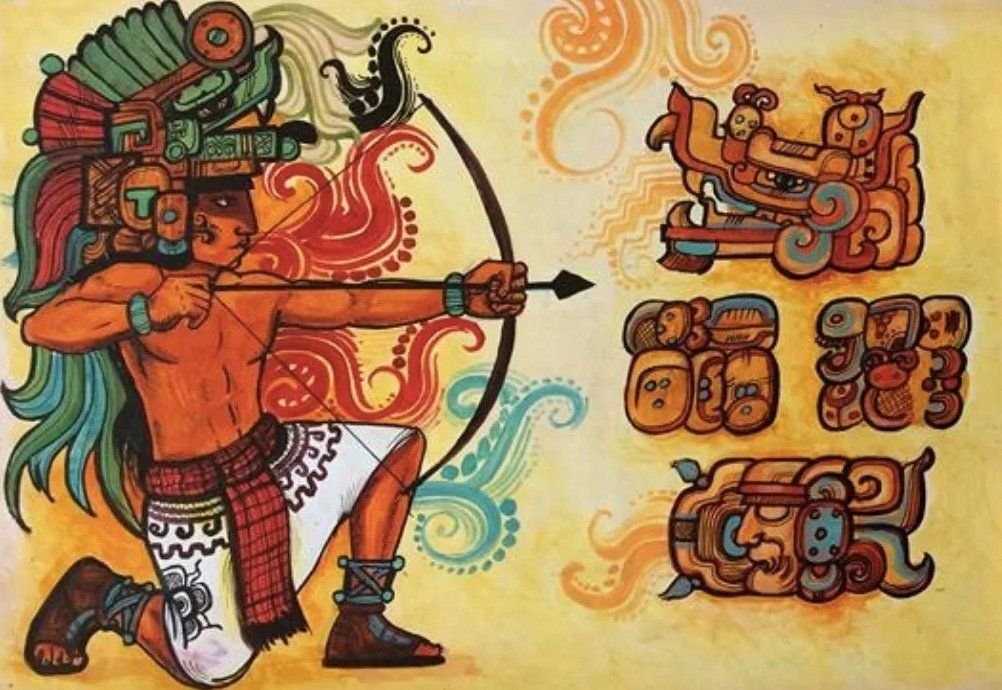

Исчезнувшая индейская цивилизация оставила после себя ещё очень много неразгаданных тайн и секретов. Вашему

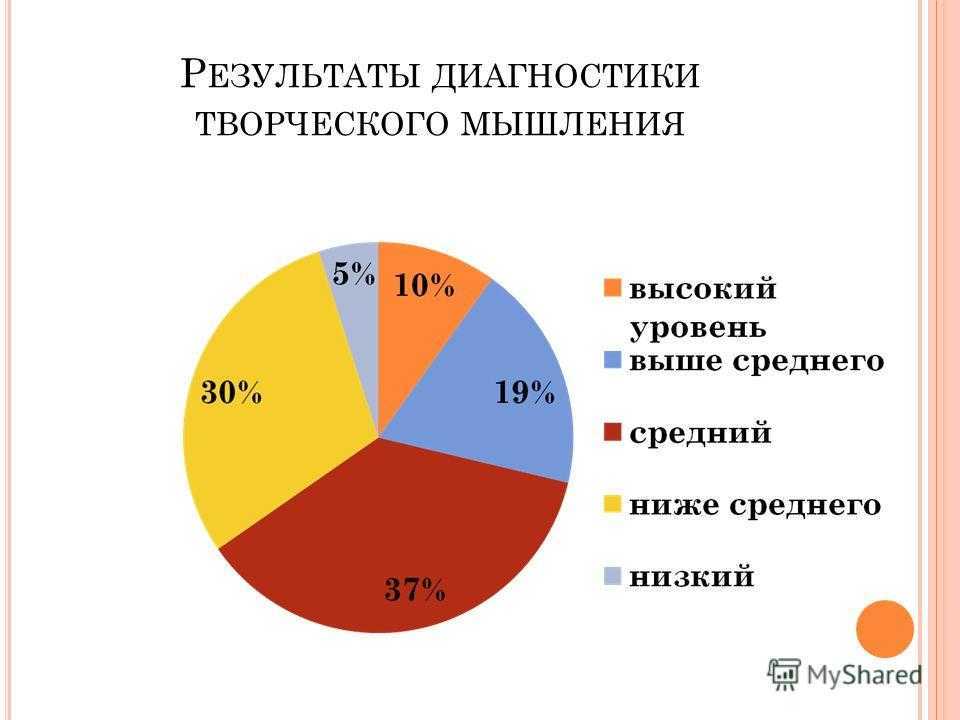

Человеческий мозг - самый сложный объект для изучения. В нем кроется много тайн и

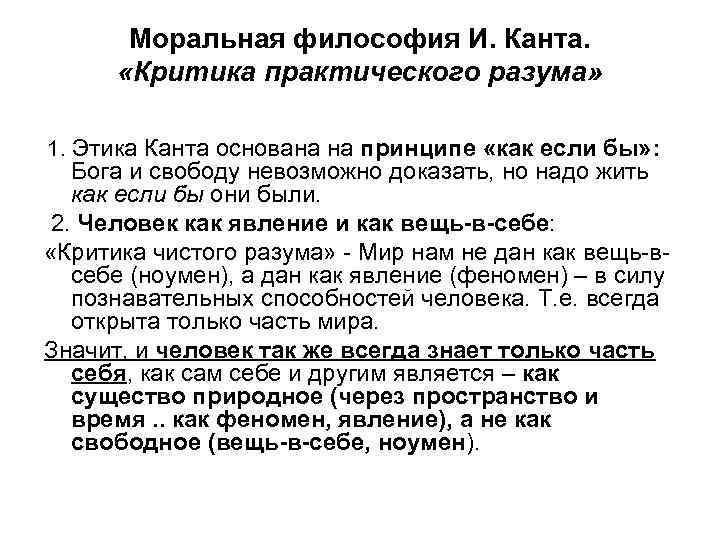

Иммануил Кант – великий немецкий философ, оставивший значительный след в истории всего человечества. Философия

Неизмеримый вклад в педагогику Ян Амос Коменский внес огромный вклад в развитие педагогики как

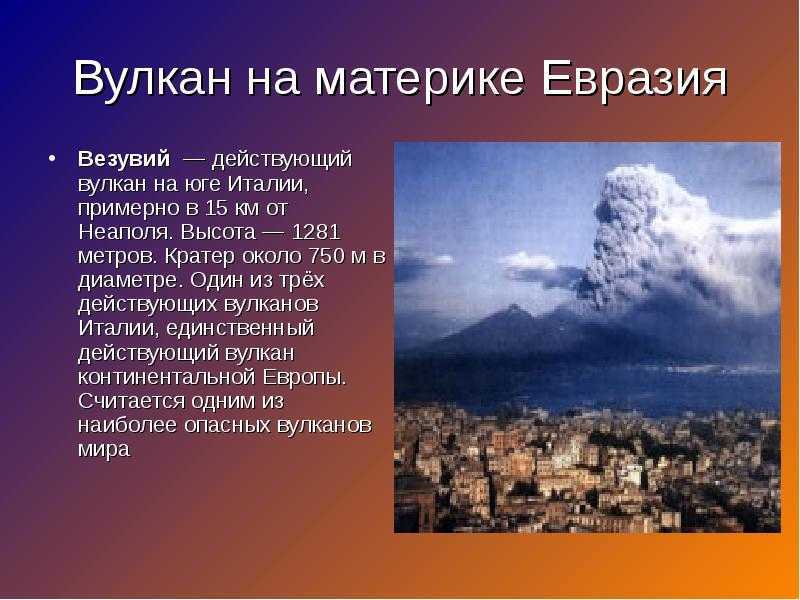

Самый опасный вулкан в мире: до сих пор считают ли что это Везувий? Продолжает

ᐉ А в основном прекрасная маркиза все хорошо. А в остальном, прекрасная маркиза, Всё

Внимание — способность человека фокусироваться и удерживать сосредоточенность на предмете или деятельности. Подробнее в

Все люди рано или поздно становятся участниками конфликта. При этом они могут быть его

Вербальное общение: что это такое, примеры, виды, значение Приветствую Вас, друзья! Существует два основных

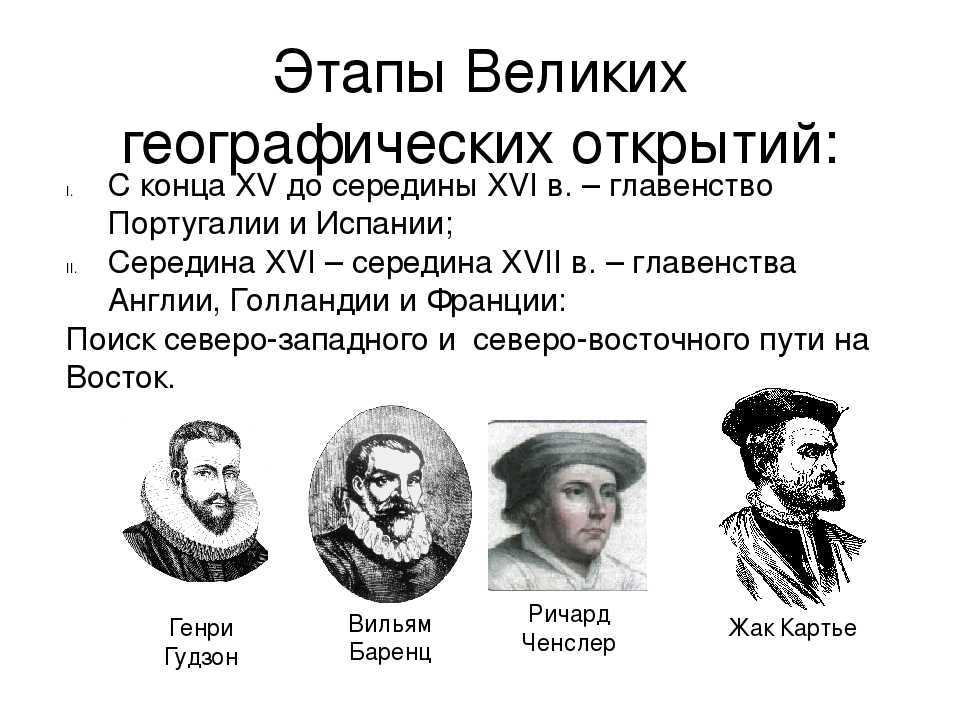

В XV веке европейцы стали активно исследовать планету, и в результате им удалось убрать

Теория по теме «Этапы Великой Отечественной войны. Героизм советских людей. Идеология и культура в

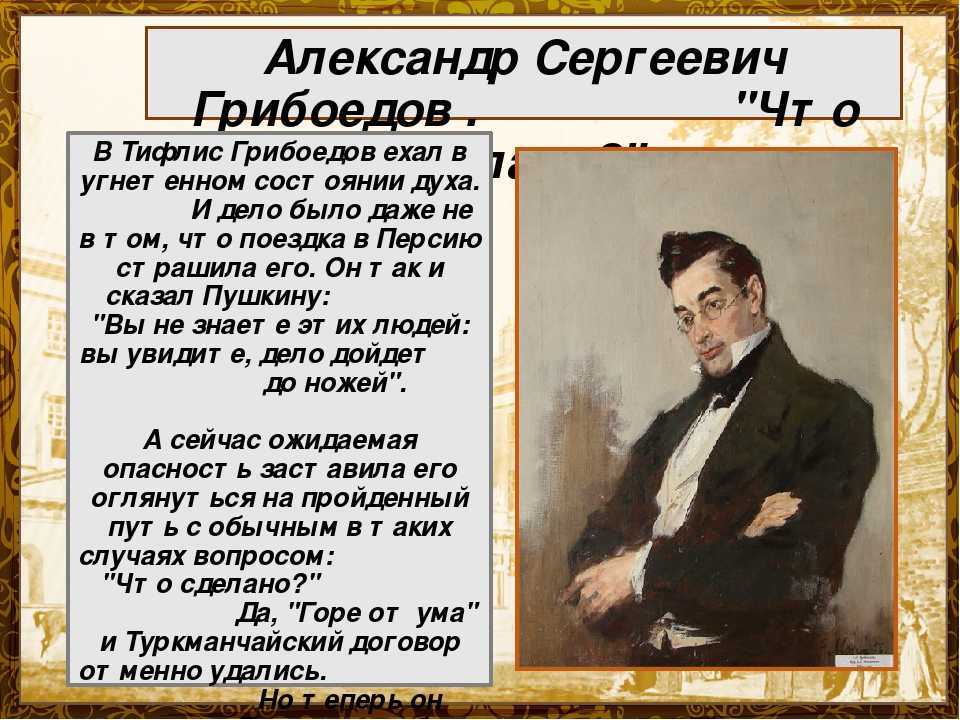

Краткая биография автора бессмертной поэмы "Горе от ума", писателя, композитора, дипломата Александра Сергеевича Грибоедова.

На планете около 117 миллионов озер разной величины. Если вы задаетесь вопросом какое самое

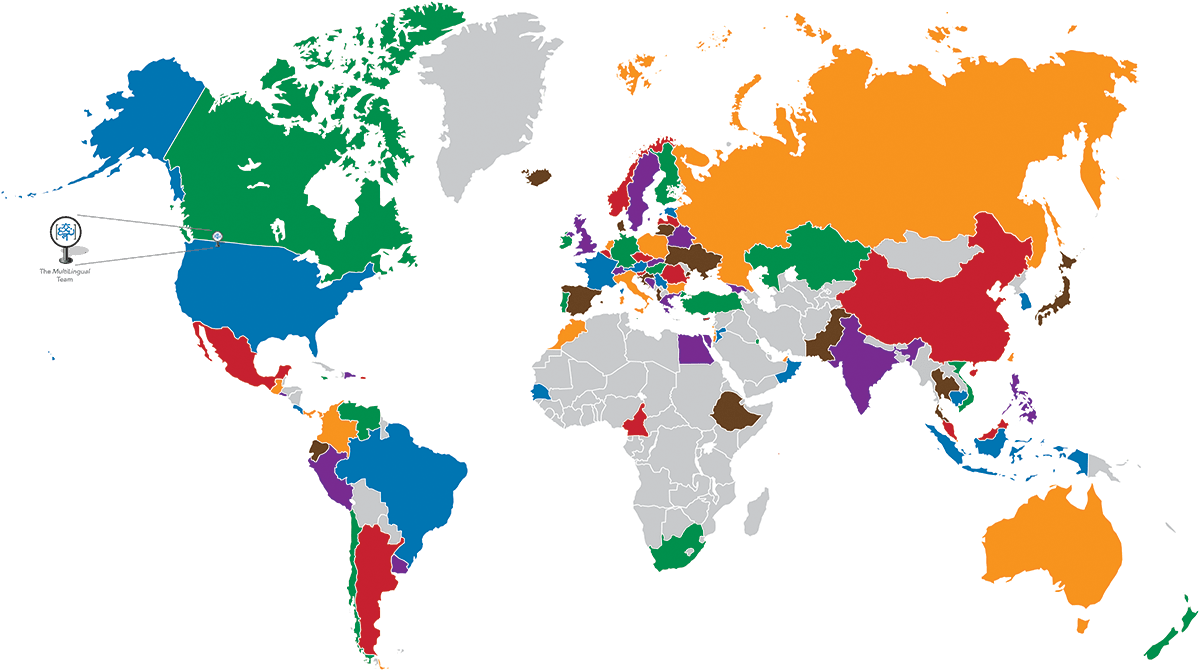

Все больше людей выбирают для изучения несколько распространенных языков. Но есть на нашей планете

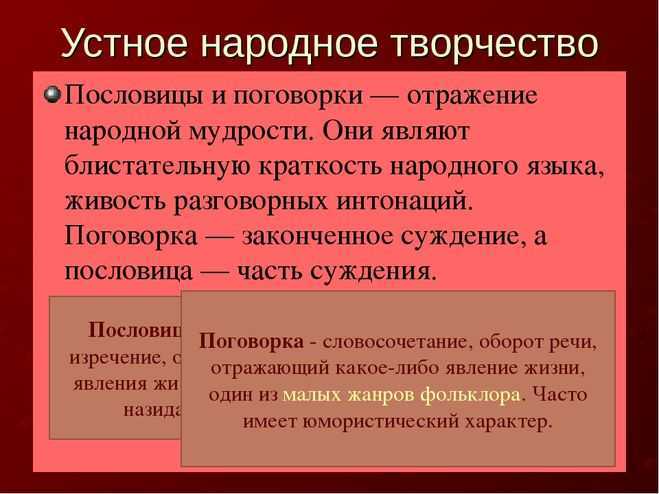

В данной статье вы расскажете об особенностях устного народного творчества и основных жанрах фольклора.

Вещи, события из прошлого для тех, кто не любит пропускать новые фактыВероятно, одна из

Подборка лучших фильмов про необыкновенные судьбы детей, ставших сиротами. Захватывающие приключения и суровые испытания

Сегодня поговорим о том, к чему все усиленно стремятся. В зоне нашего внимания наречие

Наверное, ты думаешь, что больше всего хлеба едят в России, но это далеко не

Нет людей с одинаковым характером, но что это такое, какие черты характера различают, на

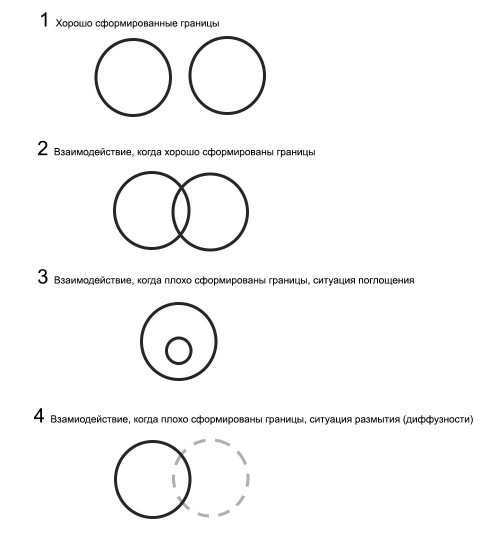

Тест на созависимость – это отличная возможность узнать себя лучше. Однако прежде нужно определиться

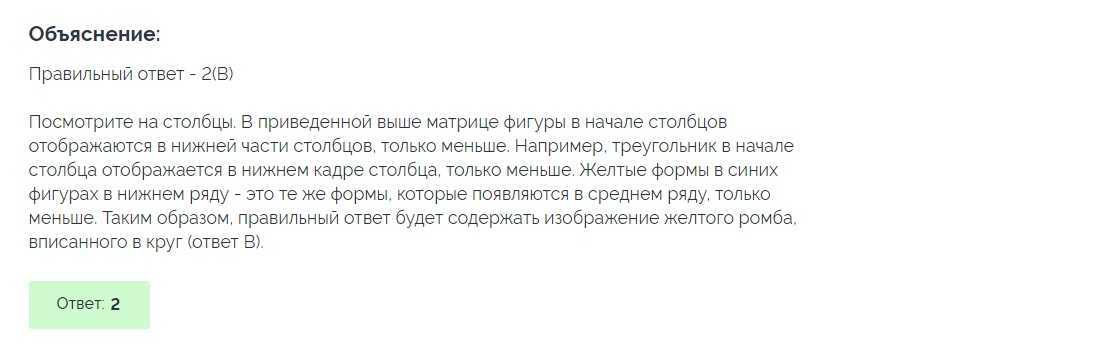

Логические тесты на абстрактно-логическое мышление при приеме на работу → что это, как решать